The 2024 Boeing Technician Outlook: A Closer Look

Boeing's latest Commercial Market Outlook for the next two decades sees a steady increase in global fleet size but a modest growth in North America, reflecting airline travel's relative maturity in the region compared to higher growth markets. The accompanying forecast for technicians reflects this, as the global demand for skilled workers continues to rise, but North America's need--while still significant--will not climb as much as others.

Boeing's latest Commercial Market Outlook for the next two decades sees a steady increase in global fleet size but a modest growth in North America, reflecting airline travel's relative maturity in the region compared to higher growth markets. The accompanying forecast for technicians reflects this, as the global demand for skilled workers continues to rise, but North America's need--while still significant--will not climb as much as others.

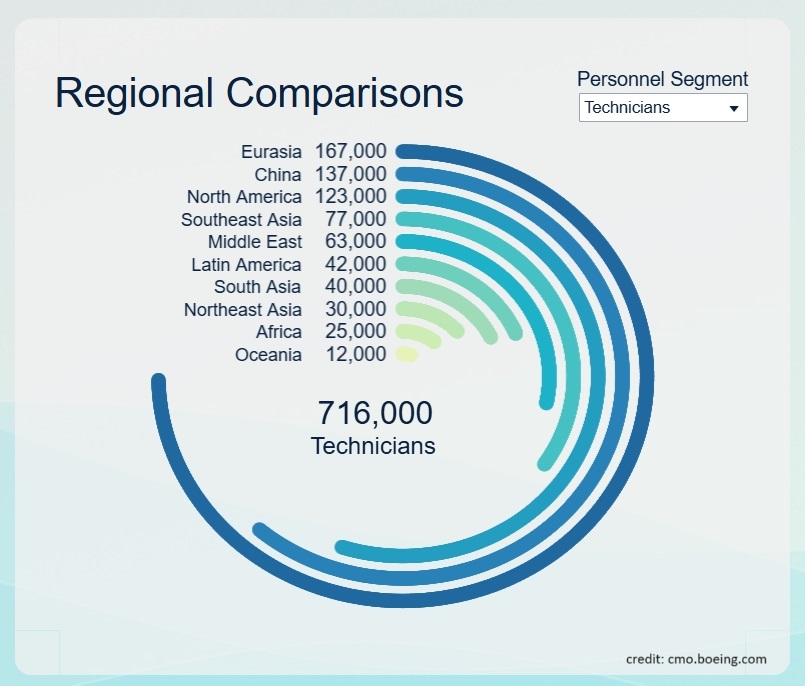

The 2024-2043 outlook sees demand for 716,000 new technicians during the next two decades, a 38% increase over last year's comparable forecast. North America will account for 123,000, or 17%. Only two regions in Boeing's forecast will need more, Eurasia (167,000) and China (137,000), the forecast shows.

North America's projected total demand for new, skilled mechanics and technicians over the next 20 years is slightly lower than last year's figure. The region's expected average annual fleet growth of 1.5% is the lowest in the forecast, and is less than half of the global fleet's projected figure of 3.2%. Current and future-generation aircraft require less maintenance than their predecessors, particularly on labor-intensive airframe checks. So while the fleet will grow slowly, it is expected to steadily become less maintenance-hungry on a per-aircraft basis.

Boeing's fleet forecast underscores this. Today's global fleet of 26,750 will require about 310 million maintenance hours this year, the forecast projects. In 2043, the fleet will have grown 87%, to 50,170. But maintenance hours will have increased 82%, to 565 million. Boeing projects about 47% of new deliveries being offset by retirements.

The forecast factors in only commercial aviation. Demand for business aviation, civil helicopters, or the emerging area of urban air mobility is not reflected. Explore Boeing's latest forecast here.